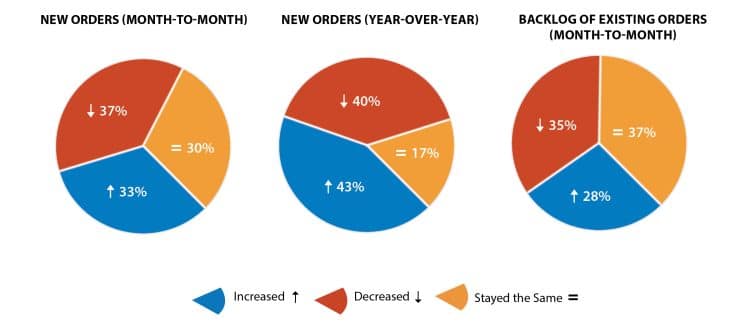

New Orders (Month-To-Month)

In the latest June survey, 28 percent fewer businesses reported an increase in the number of new orders (month to month) compared to the previous April survey. This difference was equally split between those businesses, indicating a decrease (+14 percent) and those indicating no change (+14 percent).

June April Increased 33% 61% Decreased 37% 23% Stayed the Same 30% 16%

New Orders (Year-Over-Year)

However, when comparing answers to year-over-year new orders, the results are less dramatic. 10 percent fewer businesses responded, “stayed the same,” and the difference was split between “increased” and “decreased” at just 5 percent higher for each.

June April Increased 43% 38% Decreased 40% 35% Stayed the Same 17% 27%

While some individual shed businesses indicate increases in units ordered, an offsetting percentage logged decreases in units ordered, leading to the conclusion of a stagnant overall sales environment.

Backlog of Existing Orders

The question about the backlog of existing orders showed no change in responses to unit increases from the April to June survey. However, fewer businesses reported that their backlog of orders had remained the same. The most appreciable change was with those reporting a decrease in their backlog.

June April Increased 28% 28% Decreased 35% 27% Stayed the Same 37% 44%

If you read between the lines, the results of this question, we believe this to be a healthy position given the supply of sheds in the market. Not tying up capital in buildings sitting idle makes for a more sound, nimble business. Conserving cash during a slowdown is a hard proposition that only the best-run operations can pull off.

Notable Comments

- Shed sales have been weak, although we did see an increase in June.

Camps & cabins are definitely what keeps us busy. – Northeast - My responses likely look contradictory. Sales overall were down in May and are still slow in June MTD – but, custom orders (vs. stock sales) have been decent which has led to an increase in order backlog. Also, we had one builder quit and we did not hire to replace him – again affecting our order backlog. This is also likely the explanation for a decrease in stock despite slower sales. – South

- Shed sales are steady at this time, nothing crazy – Midwest

- The year started out great but it then died in April. May recovered some but has been slow ever since. – South

- The tiny home part of our business has dramatically increased. – South

- 2025 much stronger overall than 2024. Great spring. Sales staying stronger through Q2 than typical. – South

- Seems the noise in the market is louder than the facts. Economic indicators point to positive trends, yet consumers are hesitant to spend on larger ticket items. – South

Responses by Region

| 12% | Northeast |

| 26% | Midwest |

| 53% | South |

| 6% | West |

| 4% | Canada |