It has been exactly one year since Shed Business Journal began sending surveys and collecting data. And although the latest results may sound like a grim prediction—and may feel even more dramatic to experience—it is important to note that this latest survey shows an improvement from the August 2024 survey.

More builders reported an increase in New Orders (+15% combined for Month to Month and Year Over Year), and fewer builders reported a decrease (-17%) than in the August 2024 survey.

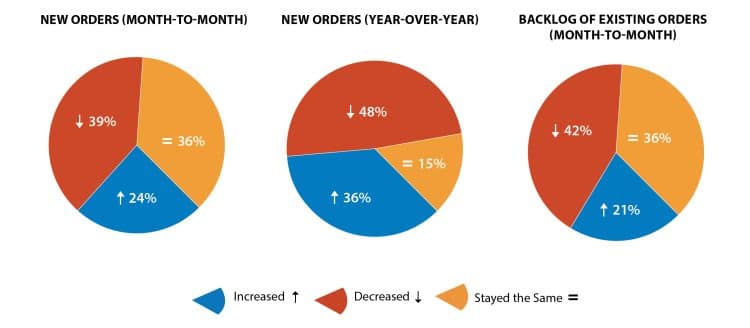

New Orders (Month-to-Month)

Fewer builders responded that the number of new orders had increased for their business from the month of July to August. Just 24 percent cited “increased” orders. This is 9 percent fewer builders responding in the positive compared to the May–June period.

More builders (+6%) reported “no change or same” in the number of new orders in the latest survey. Only 2 percent more builders responded that their new orders declined for the period in question.

August June Increased 24% 33% Decreased 39% 37% Stayed the Same 36% 30%

New Orders (Year-Over-Year)

A general slowing in sales activity can be felt in the numbers reported for year-over-year new orders. Fewer respondents indicated an increase, and even more reported a decrease in the year-to-year comparison. Taken together, this represents a 15-percentage-point swing in a direction that indicates stagnant sales activity.

August June Increased 36% 43% Decreased 48% 40% Stayed the Same 15% 17%

Backlog of Existing Orders

| August | June | |

|---|---|---|

| Increased | 21% | 28% |

| Decreased | 42% | 35% |

| Stayed the Same | 36% | 37% |

There has been a steady increase in the number of companies reporting that their backlog of orders has been declining. This has been a trend for the past three reporting periods, which cover January through June of this year.

This stands to reason as shed dealers and shed lots cycled through their on-hand inventory, and builders were producing at their seasonal high point through the summer months.

Decreases in backlogs were at their highest in the December 2024 survey, when 50 percent reported “decreased” and only 9 percent reported “increased.”

A decrease in order backlog could be translated into more units sold. An increase in order backlog could signal a slowing sales environment. On the other hand, these results could indicate a production slowdown due to an operational problem or something entirely different.

There are many ways to interpret order backlog. How do you see it? Let us know by sending an email to marty@shedbuildermag.com.

Notable Comments

“Our sales have doubled this year. This is only our second year in business, though, so not much to compare it to.” — Northeast

“Demand has been steadily decreasing in 2025.” — South

“August is typically slower. No surprises here. I’m very optimistic about the rest of ’25. If Trump can get interest rates down, it’d be an added bonus!” — Midwest

“For the last two months, shed sales are down 90 percent.” — West

A Supplier Responds

I am a large coating supplier to the shed industry. We operate in all regions. Sales are off during the first quarter almost 10 percent from the same period in 2024. Industry output peaked in 2022. There has been a slow decline since October 2022.

There are many reasons. Consumer confidence has not been that strong in 2024–2025. The average prices for sheds are at an all-time high. Only your vehicle and your home will cost more. Tariffs have increased the price of fasteners, metal, doors, windows, and hardware. Canadian tariffs could increase the cost of siding and dimensional lumber.

On the bright side, the North American shed building industry will continue to thrive. Americans have to have sheds to put all the stuff in that they buy every year. The smartest companies will adapt to the winds of change.