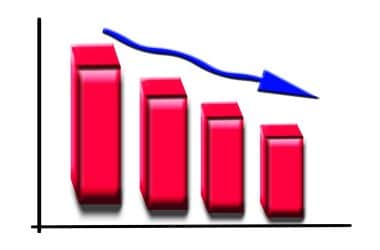

The most recent survey of shed manufacturers, builders, and dealers, conducted in October by Shed Business Journal, showed signs of stabilizing a decline in sales noted in the August survey.

This reversal, while slight, is revealed in the analysis below.

Employment levels remained stable and no significant effect on shed prices by changes to material costs was reported.

BACKLOG OF ORDERS

The most encouraging sign that the previously reported sales decline is slowing, came from growth in the backlog of existing orders. 20% of respondents said that their backlog of orders increased in the past month compared to only 4% from the August survey. This conclusion is further supported by only 42% saying that orders had dropped, an improvement of 6% over the 48% who stated a decrease in August.

NEW ORDERS

Month-to-month new order increases showed improvement with 29% of respondents reporting an increase from the previous month. This is 7% higher than the August survey results (22%).

Respondents who indicated a decline came in at 45% compared to 50% from the previous survey. This is another positive indication that sales may be improving.

While shed manufacturers and builders say that year-over-year orders are still lower in 2024, the number who stated this dropped to 51% compared to 54% in the August survey. 26% indicated orders tobe higher, up 3% from August. And 23% stated that they have experienced no change in 2024 orders matching survey results from August.

EMPLOYMENT

The main takeaway from the employment question remains that two-thirds (66%)of respondents replied “no change” in employment levels. This is an uptick of 5% from August (61%) which explains a drop in responses to “hired/hiring more people” (18%) compared to August’s 23%. Reductions to the workforce remained unchanged at 16% in both the August and October surveys.

Four out of five respondents (80%) reported “no change” in material costs from month to month, resulting in no impact to shed prices at most shops that participated in the survey. However, 15% of respondents indicated material costs were linked to increased shed prices. Conversely, 9% of respondents said that changes in material costs caused shed prices to be lower. This is the exact opposite percentage response to these selections from the August survey.

NOTABLE COMMENTS FROM RESPONDENTS

- Sales this year, from our perspective, can be summed up in one word—inconsistent. Month-to-month has been up and down. Geographically, our dealers have also been inconsistent— strong one week, dead the next. Meaningful trends have been difficult to determine.

- Too many people saw the shed industry as an open door as shed production lagged shed demand in 2020. The lag happened, not only because of unusual demand, but also because supplies were restricted, and some workforces were pressured to stay home. The number of shed companies and amount of production infrastructure, in my opinion, now outpace shed buyers. The question: who’s going to blink first?

FOLLOW-UP (FROM THE AUGUST 2024 ISSUE)

Regarding the article “Candid Comments on the State of Shed Business”:

We are 100% in agreement with this article and what was stated.

As a shed builder for 26 years, the industry has changed so much and not for the better. We are constantly dealing with lesser sheds in our area that we are compared to when in fact it is NOT an apples-to-apples comparison. But customers are all concerned about getting a cheap shed; they overlook quality and ongoing customer service until something goes wrong with their “cheap” shed.

Sadly, it’s not just the shed business that we are seeing this same issue with. It is also the Amish furniture we sell as well. We are a dealer for an Amish Furniture company that once was small and simple back 20-some years ago when we started selling for them. However, they have gotten so big that we

can hardly keep up with the overwhelming array of items they are now selling. In trade with their “growth,” we are seeing a decrease in the quality of their products. To the point we are considering walking away from that portion of our business because we are finding that we are too “small” for the big company to deal with when we have issues with their furniture. The companies are more concerned about their million-dollar dealers, forgetting it was smaller dealers like ourselves that helped get them off the ground.

We are just like what was stated in the article … brushed aside and told to refer to the fine print on everything.

Best Regards Anonymous

How does your shed business compare? Do you see things differently? Let us know where you stand. Share your comments at survey@shedbuildermag.com.

Shed Business Journal will be compiling survey results and publishing this information in aggregate in an upcoming issue. Individual responses will remain confidential. Take the survey next time, email the word “subscribe” to survey@shedbuildermag.com.