Results from the final survey of 2024 turned out to be mixed. Indications are that sales performance month-to-month across the industry ticked lower compared to the previous survey’s slight improvement in sales. A seesaw sales landscape has been a common theme with manufacturers who have spoken with Shed Business Journal. Some manufacturers have described the market as volatile although we don’t specifically ask for percentages to be able to back this claim.

Mixed results may be due in part to the random delivery method to an anonymous recipient. Surveys are delivered to email inboxes, or fax numbers, and sometimes both. Recipients have previously self-identified as, or are known to be, shed manufacturers, builders, and dealers who currently receive and read this magazine. Mixed results may also be due to seasonality for some businesses during the winter months. Fewer responses were returned compared to previous surveys.

This was our third survey report in what will become six total surveys anticipated in 2025. Surveys will be delivered in the months of February, April, June, August, October, and December. Results will be reported in the next issue immediately following the survey. The survey look-back period of just one month makes the survey report a timely indicator.

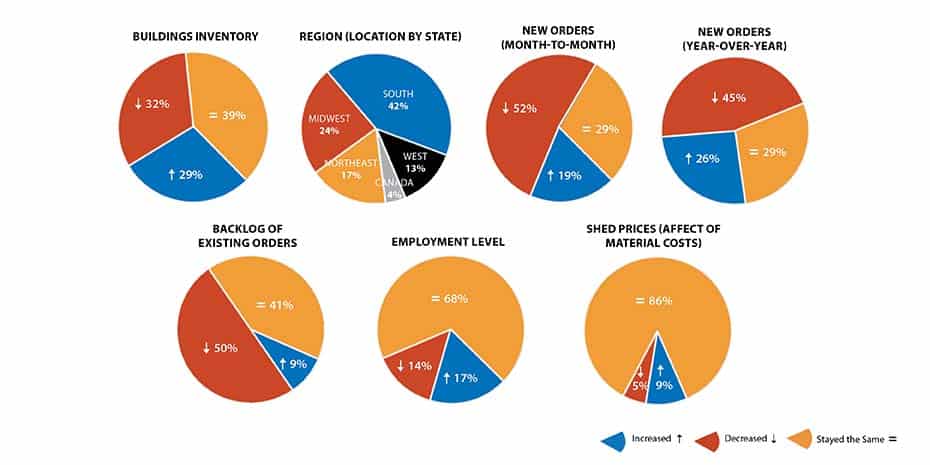

Two additional questions were added to the December survey format, one about Buildings Inventory and the other Location. Buildings Inventory is an important metric for any shed business. The number of finished buildings in stock, and on your books, can have a positive or negative impact on cash flow. Too much inventory ties up cash. Reducing inventory frees up cash for expansion and other purposes.

Where respondents operate their business should be considered in the reader’s own analysis and reliance on these results. Regional differences are common in the shed industry. In the future, geographical location will factor into our analysis of survey results. As we develop an advanced, more in-depth version of this survey in the future, a regional breakdown of the data will provide more targeted business insights. Look for more details in the coming months about becoming a core regional survey partner.

It is important to note that we are inferring that “new orders” translates to units sold and not exactly sales which coincides with “revenue”. While new orders (units) may be down, there are instances where sales (revenue) could be up at the same time. This is especially true with larger and larger structures being built. We frequently interchange “new orders” with “sales” in our analysis of survey results.

NEW ORDERS

Nearly one third of all respondents stated that New Orders from October to November were flat and unchanged. This is significant because the result mirrors the previous two surveys which covered the period from June to September of 2024. However, the comparison stops there. Responses indicating an increase or a decrease in new orders show that new orders can be up one month and down the next, or vice versa. Inconsistency in new orders reported leads to the conclusion that sales have been unpredictable in 2024 and certainly for the second half of the year that we surveyed.

Responses to New Orders (Year over Year) showed steady improvement. 45% of respondents said that new orders decreased, which was 6% lower than the previous survey and the first time to dip below 50% out of our three surveys. Could unit sales be improving across the shed market?

29% of respondents selected “stayed the same” (6% higher than the previous survey) when asked to compare new orders this year with last year. Respondents indicating “increased” has been a stable 26% (unchanged from the previous survey). We tend to look at this as an optimistic result for the shed market through the prism of the glass being “half full.”

BACKLOG OF ORDERS

Backlog of Orders follows the same up and down pattern of New Orders—unpredictable. There was a double-digit decline of 11% of respondents indicating an “increase” from the October survey (20%) and a corresponding increase of 8% in responses indicating a “decrease” in order backlog (for a total of 50%).

EMPLOYMENT

Changes to the workforce among survey respondents consistently reveal that two-thirds are maintaining the status quo. A nearly equal amount report hiring (17%) as those who report reducing (14%) employees.

SHED PRICES

According to our survey, shed prices remain stable with 86% of respondents saying that no change in shed prices was made due to material cost increases in the past month. Fewer respondents (9%) stated having to increase prices because of material costs. This was lower than the October survey by 6%. And 5% of respondents lowered shed prices because of changes in their material costs.

NOTABLE COMMENTS

Several survey respondents provided the following comments.

• More rental returns this year.

• Late summer into early fall was very soft but late fall was very good again. As a builder for 30 years, the soft months were something we never experienced in history.

• Business seems to be back to a more pre-covid era. As salesmen, we are no longer “order takers” but have to pursue customers and be “order makers”.

• Overall, we are about 15% down from last year. Our orders have decreased in the past month but primarily because of the seasonal nature of our business. Year to year our fall was stronger than last spring/early summer.

• We have seen an increase in orders every year in the last quarter and first quarter of

our year.

• Year-to-year to date overall sales are down 22% dollar wise. Units very close to same. Market feels soft.

• Our sales base has changed over the last year. The upper bracket has moved up and the lower bracket has moved down. On average, expensive sheds (over $15,000) are more expensive, and small cheap sheds are smaller and cheaper than last year. Our most popular shed used to be the 10 by 12 Lofted Barn (around $6,000) but we hardly sell those anymore, selling a lot more 6 by 8 and 14 by 24

• The number of sheds sold is up over last year. The sq. ft. has gone down from last year. The dollar amount has gone down since last year.

• With the election over, I expect a big jump in sales in 2025. Just look at the stock market! Stock up on inventory this winter, you’ll need it!

KNOWLEDGE IS POWER

I am unsure who coined this phrase but there’s a lesson in this for all of us. Having knowledge, or being informed, can make one feel powerful. In modern terms “Content is King.” I have heard this phrase when describing interesting and relevant information presented online.

However, the phrase “knowledge is power” is arrogant. A better way to look at it is this, knowledge gained from reliable information can lead to better decisions. Better decisions lead to better employers, better employees, better operations, better products, better profits, and ultimately, a position of power in the market. We all strive to be better at what we do, but we can be better without wielding said power, whether perceived or real, over others.

While it is undeniable that the shed industry is constantly changing, and some might say evolving rapidly, there remains a void when it comes to data about the shed market. A lack of good information can lead to decision-making paralysis, the inability to decide one way or the other.

Shed Business Journal is in a unique position to collect and report specific shed market data. We can’t do this without your help. We ask that you take the survey when you see it in your email or off the fax. Your responses are confidential, and your business will be anonymous. We will collect, count, and report the total of all responses in the Shed Business Climate Survey follow-up.

Our goal is to make the shed industry better by uncovering and reporting on trends that can be found through good data collection and analysis. Meaningful shed market data is valuable to your businesses.

We value our role as a source of trustworthy and credible information in all that we do. We hope that you can use the knowledge gained from our surveys to make better decisions because, as we all know, we can only grow stronger if we’re together.

Look for the February 2025 Business Climate Survey in your email inbox or on your fax machine. Shed Business Journal will keep your answers completely confidential. We log the survey results anonymously, add commentary, and publish the findings in aggregate format in each issue of the magazine. We are always interested in how we can make this survey better. Do you agree or disagree with our assessment of the results?

How does your business compare? Take the survey next time, email the word “Respond” to survey@shedbuildermag.com or fax (616) 582-6300.