Results from the latest survey conducted (April ‘25) reveal that new orders have increased significantly at a majority of shed businesses.

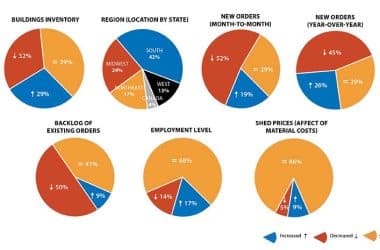

Sixty-one percent of respondents claim new orders increased in the past 30 days compared to just 39 percent (combined) reporting decreased or no change.

This is one of the largest percentage point swings reported in the short time Shed Business Journal has been conducting surveys!

A possible reason for the improvement could include the upcoming prime sales cycle in most regions, especially the Midwest and northern parts of the country.

Our survey asked three separate questions about new orders to discern how a shed business feels about its recent sales, current sales compared to results from a year ago, and changes that have occurred in its order backlog.

In the most recent survey, increases in backlogged orders were flat and in line with the previous survey results.

However, there was real change reported by the number of respondents who indicated a decrease. 27 percent of respondents claimed that their order backlog had dropped. This was 9 percent higher than the previous survey results.

This 9 percent is reflected in the exact percentage of respondents (fewer) who reported no change to their backlog of orders.

The decrease in the backlog of orders is an indication of a slowing sales environment. While certainly a troublesome metric, does an increase in new orders from month to month outweigh this? A higher number of new orders and a smaller order backlog could have a counter-balancing effect when compared to your business.

How do you feel about your backlog of orders? Care to share your thoughts? Email marty@shedbuildermag.com with comments.

The most promising results from the recent survey pertain to new orders, year over year. Responses to this question show the least volatility and the most stable, consistent improvement from survey to survey.

As more time passes since COVID, fewer respondents are comparing new orders year over year with the highs of the pandemic years.

In each of the four previous surveys, fewer and fewer respondents said year over year new orders had decreased, from a high of 54 percent last August to just 35 percent in the latest survey. This is the first time more respondents reported an increase in new orders, year over year, versus those who reported a decrease.

This reversal is an important distinction we will continue to monitor and report on.

Additional Comments

- While our sales year over year are comparable with 2024, our sales are down about 12% from the years 2021, 2022, and 2023, I expect because of Covid. — South

- As of March 31st, revenue was up 35% over 2024; Reflects a strong interest in camps, cabins, and tiny homes. — Northeast

- People are buying now, ahead of the possible tariff increase. — Northeast

- Going to be an adjustment down from the Covid highs for a few years. — South

- People are buying what they need, not what they want. — Midwest

- Customer traffic has dropped dramatically. — South

- Terrible January and February. March and April have been better than our average during that time, but really just have filled the void for the first two months. — South

- My sheds are all built on site and my sales are down. Last year at this time I was booked through August, this year I’m only booked through May. — Northeast

- March sales were soft; April is not looking any better. — Northeast

- Tell the feller who was crying about the shed industry being flooded and sheds sitting around unfinished. Life is short! Go fishing! — Midwest